Announcing Top 10 Real Estate Companies in 2019

Thứ hai, 18/03/2019

On March 15, 2019, Vietnam Report Joint Stock Company officially announced the Top 10 prestigious Real Estate Companies in 2019.

This is an independent research result of Vietnam Report, built on objective and scientific principles. The reputation of companies is assessed based on the study of the influence of financial factors, corporate image in the media and the evaluation of industry experts, specifically including: (1) financial capacity shown in the latest financial statements (total assets, total revenue, profits, efficient capital ...); (2) Media reputation is assessed by Media Coding - coding articles about the company on influential media channels; (3) Survey of industry experts; Survey residents living and working in big cities: Hanoi, Danang and Ho Chi Minh City on the level of satisfaction with real estate products / services. In addition, business surveys on operation status, number of projects, handover progress ... in 2018-2019 are also used as additional factors to determine the position of enterprises in the industry.

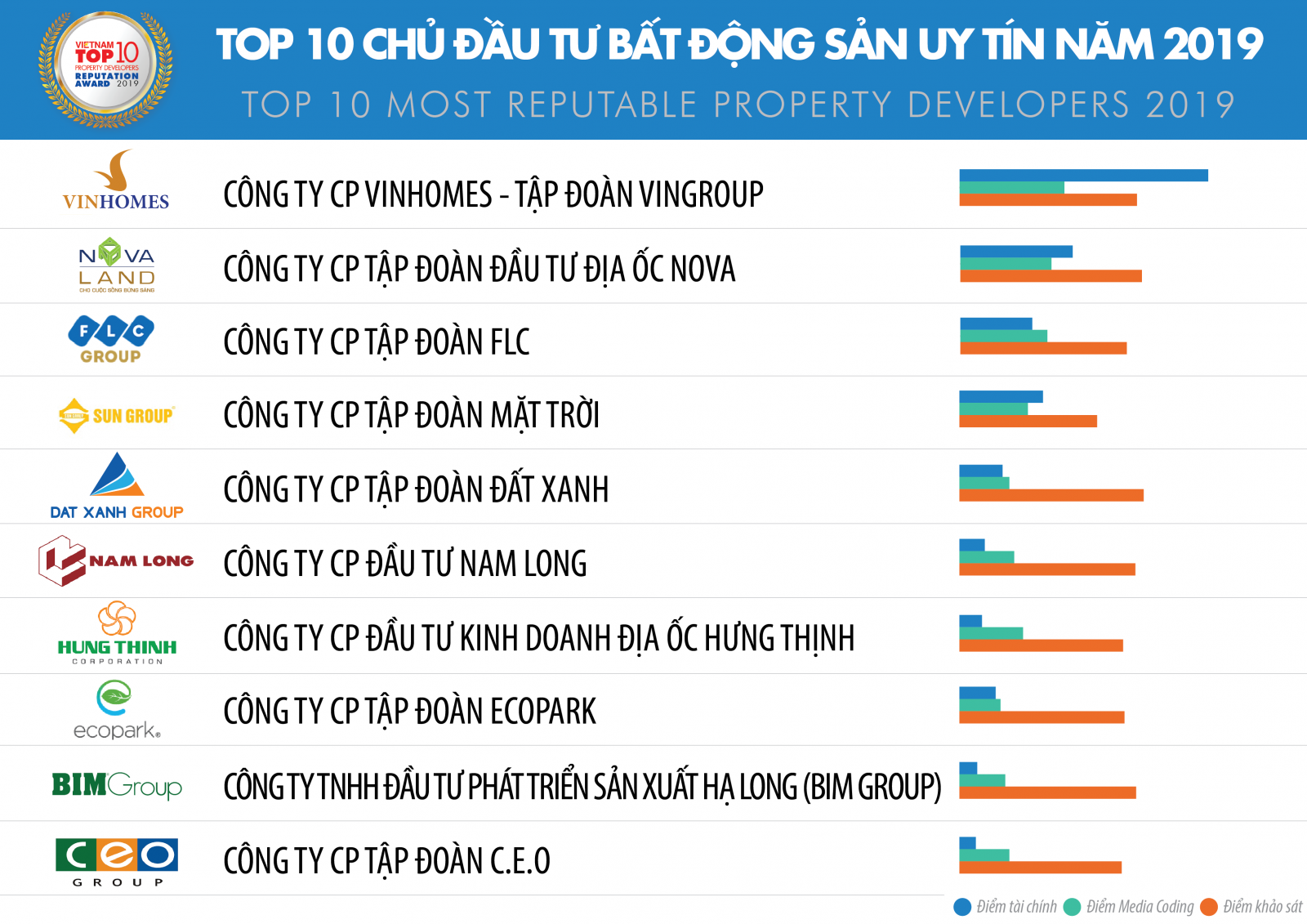

List 1: Top 10 Most Reputable Property Developers 2019

Source: Vietnam Report, Most Reputable Property Developers 2019, March 2019

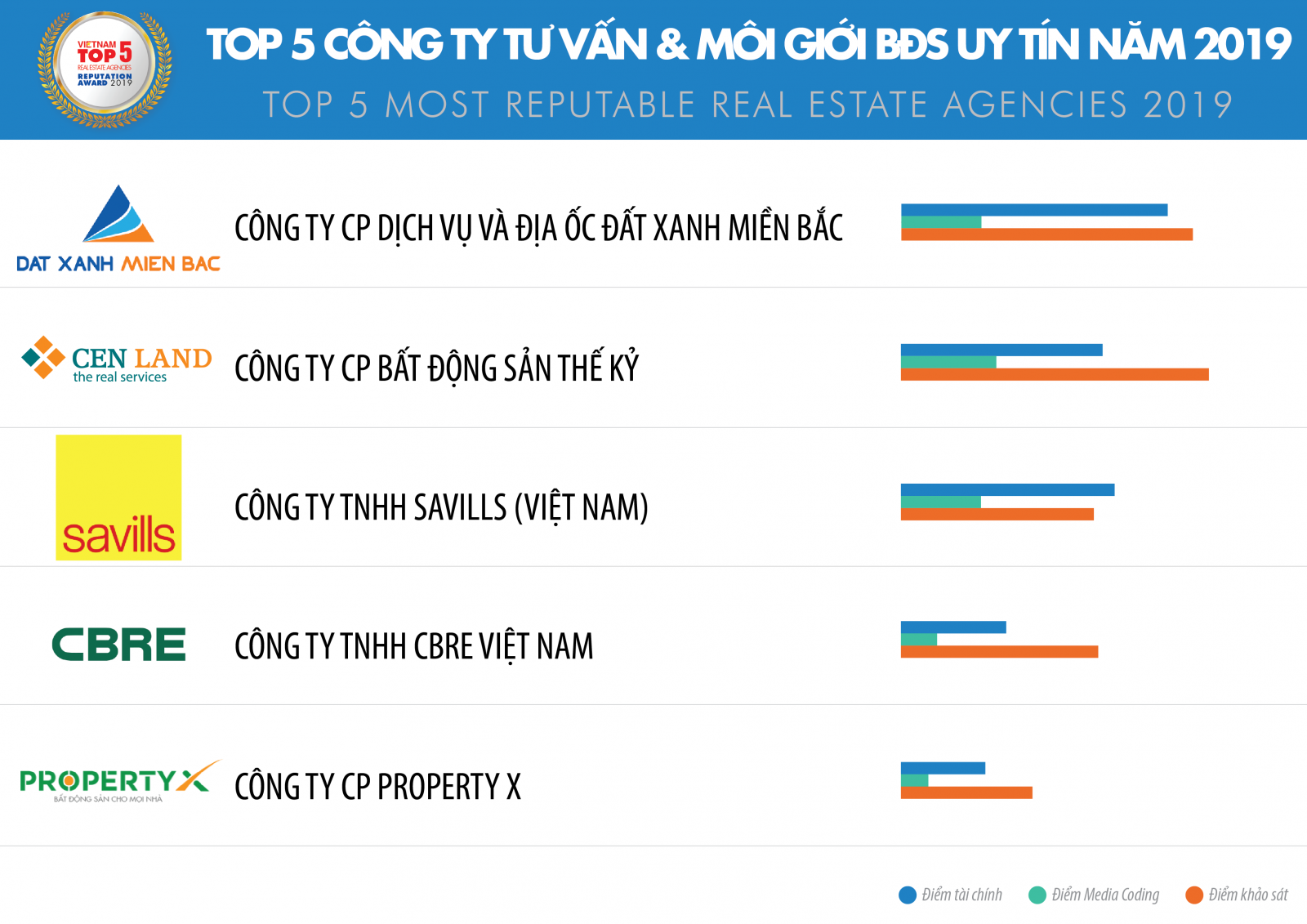

List 2: Top 5 Most Reputable Real Estate Agencies 2019

Source: Vietnam Report, Top 05 Reputable Real Estate Consulting and Broking Companies in 2019

Vietnam Real Estate - A year to look back

2018 continues to be considered a favorable year for Vietnam's real estate, driven by the following factors: (i) GDP growth per capita; (ii) Increasing production activities and booming tourism; (iii) The development of mid-level apartments: affordable prices, good liquidity; (iv) Increasing real estate investment demands of foreign investors; (v) Reducing mortgage interest rates; (vi) The rapid development of coastal cities.

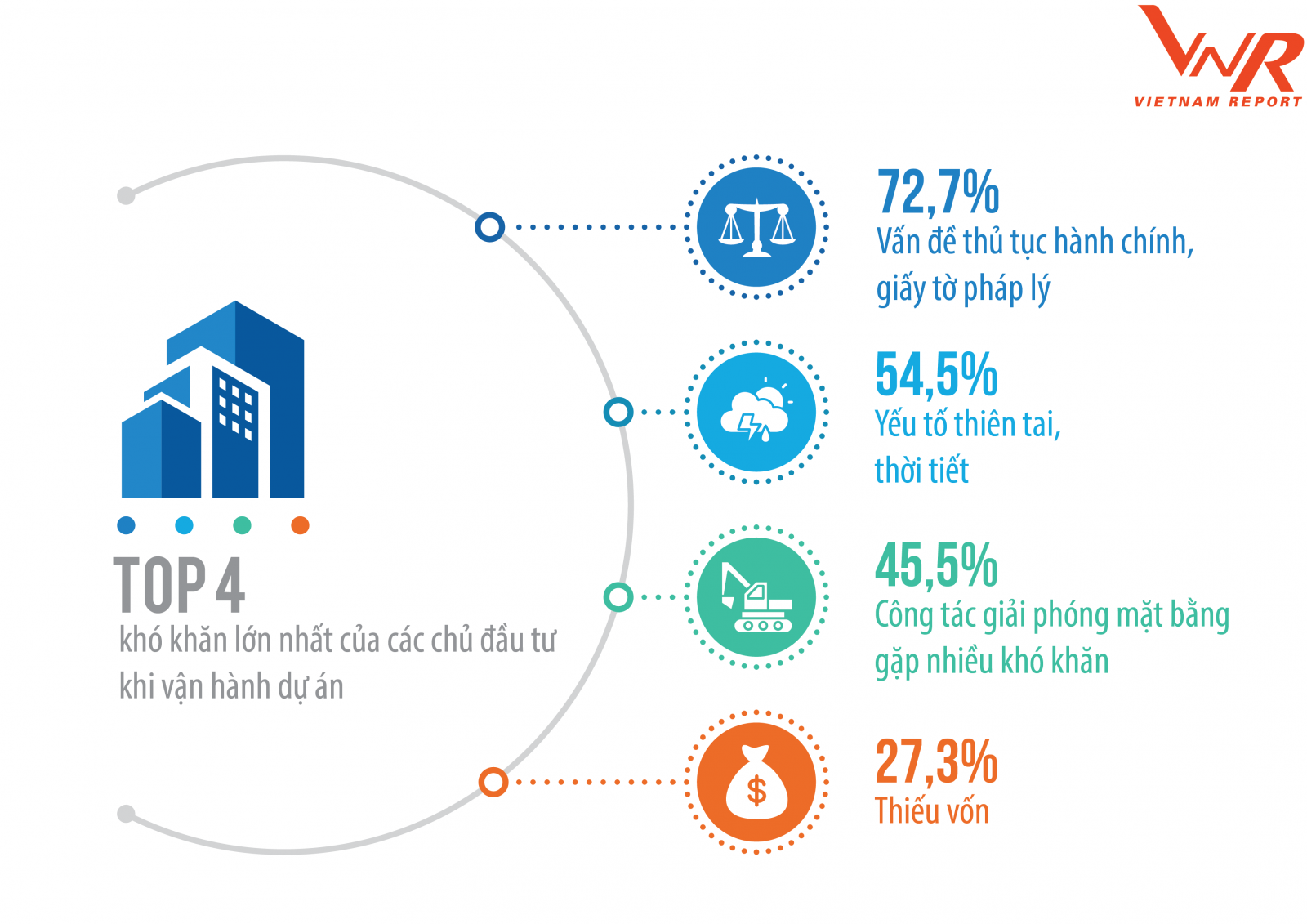

However, the year 2018 also witnessed many events that made real estate investors and traders hesistent. The fact that foreign investors move production into Vietnam and the need to find land funds to invest in real estate (especially industrial park property) increases the level of competition with domestic enterprises, which is most evident in land plot and industrial land fevers occurring in Ho Chi Minh City, Long An, Ba Ria - Vung Tau, Danang and the economic zones of Bac Van Phong, Van Don, Phu Quoc. In parallel with this, local governments and ministries have been promoting the review of the use of public land funds and inspection of land allocation on large projects makes project legal issues become more difficult. Many problems arising after the project has been completed, such as the progress of granting ownership certificates, setting up management boards, private and common disputes, maintenance funds, safety and security ... also cause headaches for owners. invest. According to the representative of the investors participating in the survey of Vietnam Report, the issue of administrative procedures and legal documents is the biggest obstacle of enterprises when implementing and operating projects.

Figure 1: The biggest difficulties of investors when implementing and operating projects

Source: Vietnam Report, Survey of Vietnam Real Estate Enterprises 2019, February 2019

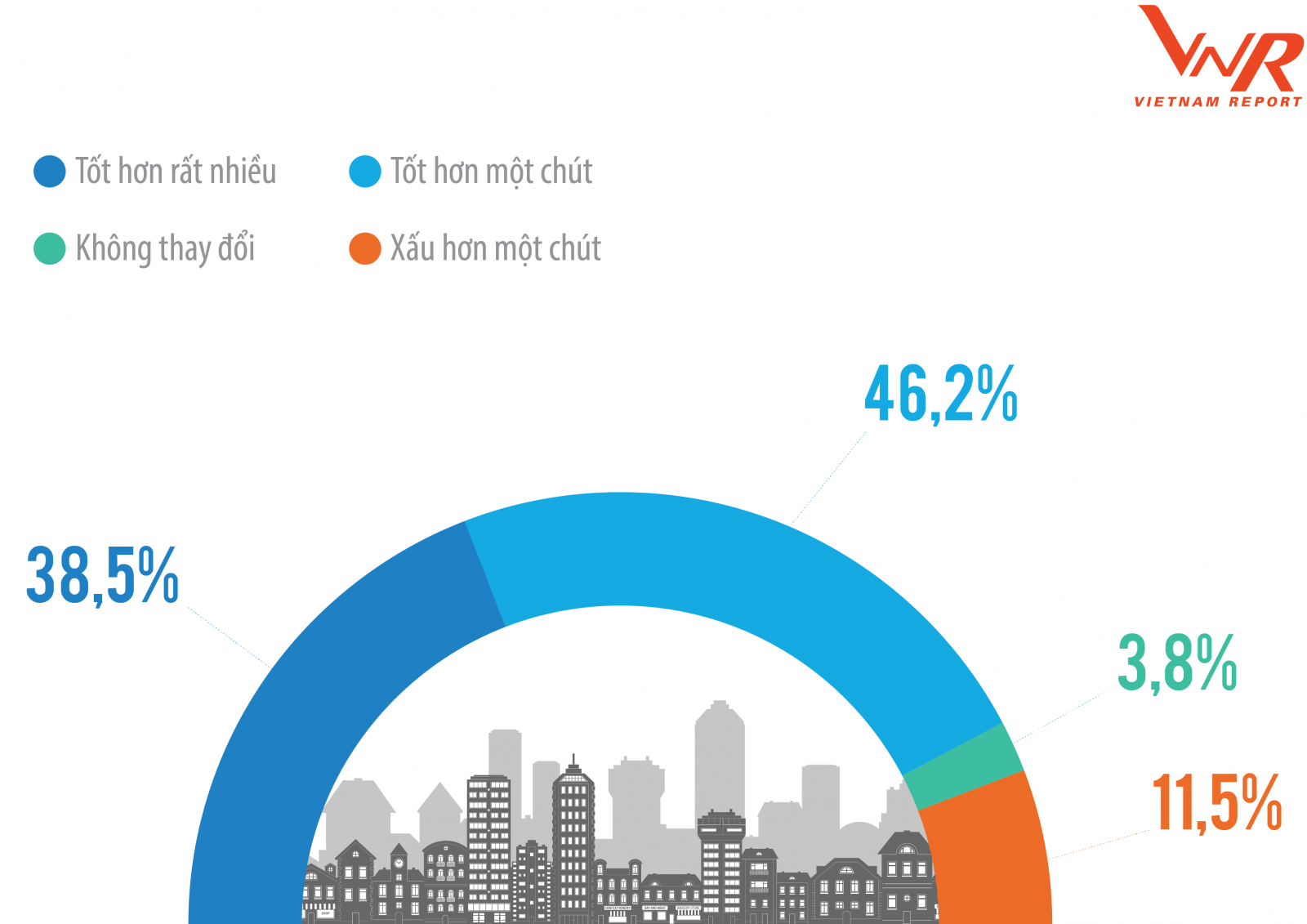

In general, Vietnam's real estate in 2018 still grows but at the allowed level. This is also a common assessment of businesses in the industry, when nearly 50% of businesses said that the overall real estate market was "a little better" than in 2017.

Figure 2: Assessment of real estate investment and business environment in 2018

Source: Vietnam Report, Survey of Vietnam Real Estate Enterprises 2019, February 2019

2019: An opportunity for strongly branding for real estate investors

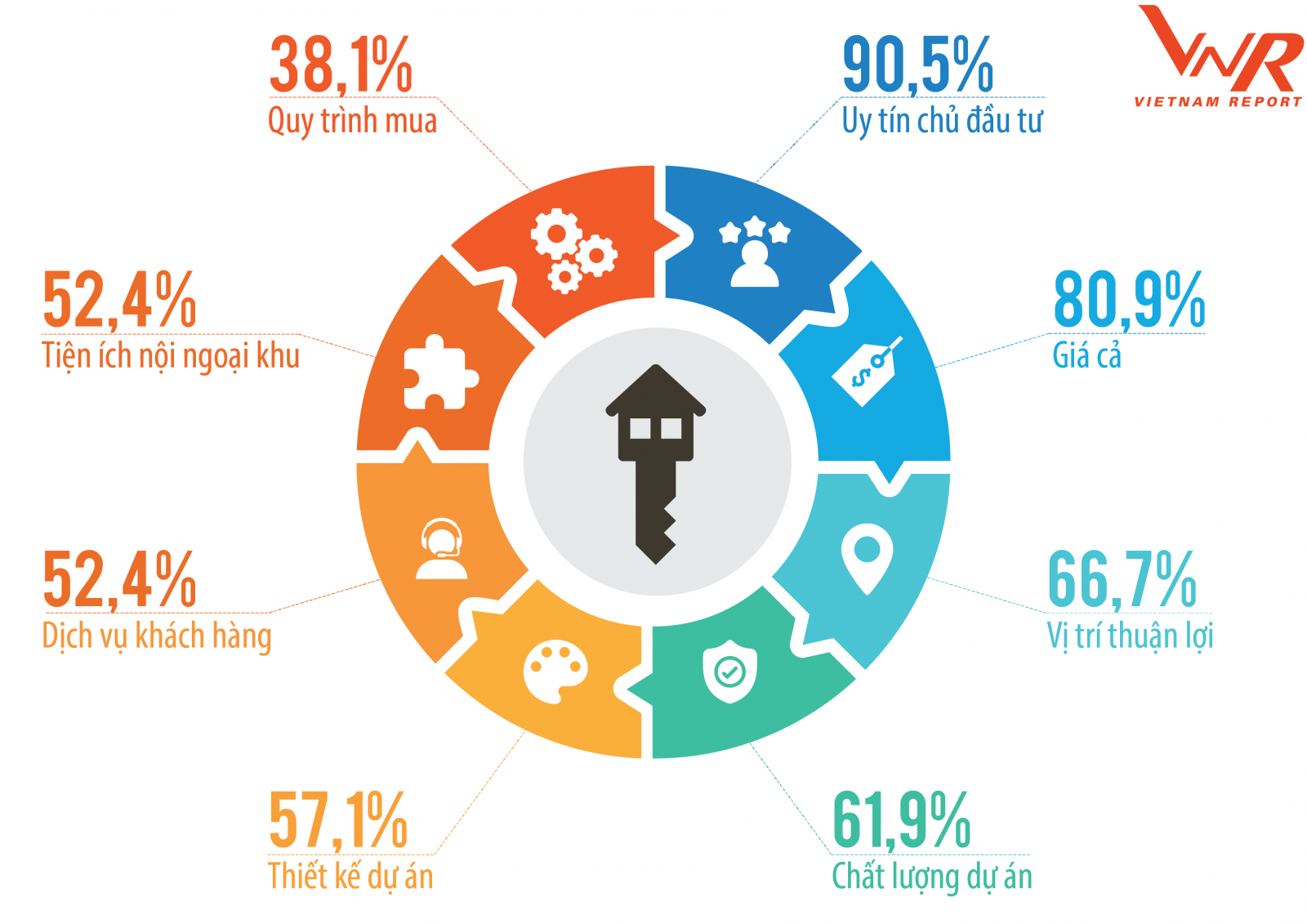

For real estate investment and business enterprises, when the market is forecasted to grow "lightly", it is time to focus on branding and reputation instead of investing in expanding market share. According to the survey recently conducted by Vietnam Report, more than 90% of customers think that " reputation of investor " is the most influential factor in making decision to buy an own house.

Figure 3: Factors that influence customers' buying decisions

Source: Vietnam Report, Real Estate Customer Survey, February 2019

In fact, the media plays an especially important role for the reputation of real estate investors, because any movement of the business, from M&A deals, upcoming projects. or problems with residents in buildings, apartments ... are reported by the media with tremendous speed through the internet and especially social networks. Media analysis results in 2018-2019 of Vietnam Report show that big investors such as Vingroup / Vinhomes, Novaland are the two names with the most appearance, with dense information coverage on impacting newspapers. However, in terms of information security (the ratio of positive and negative information in the total encrypted information of enterprises), Sungroup is a little better.Điều đó cho thấy, để truyền thông hiệu quả và giữ gìn tốt hình ảnh, uy tín doanh nghiệp, các doanh nghiệp cần cẩn trọng lựa chọn thông tin trước khi công bố.

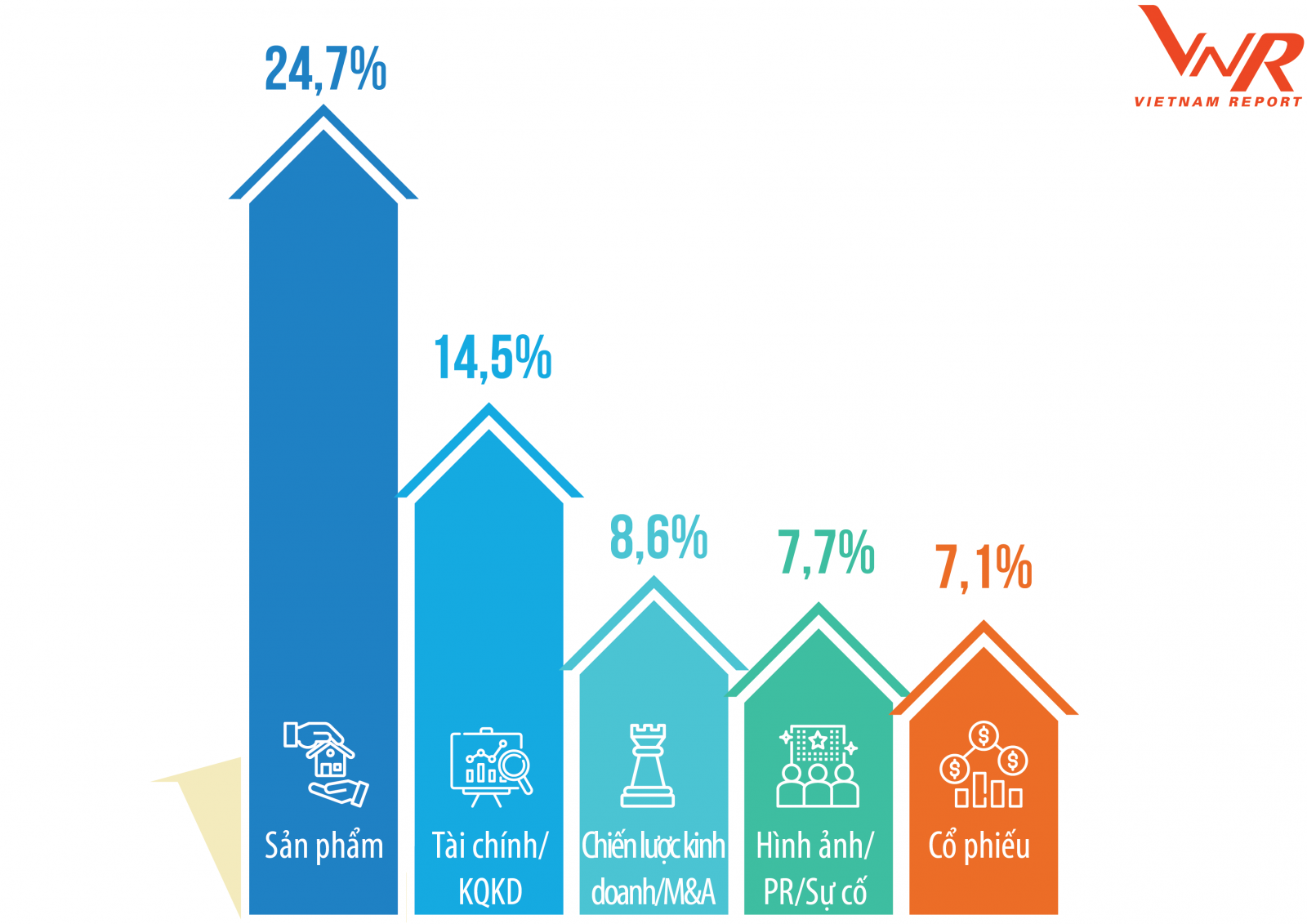

This shows that, in order to effectively communicate and preserve the image and reputation of businesses, businesses need to carefully choose information before announcing. With the frequent use of media as a means to promote products, the most frequently mentioned topic in the media of real estate businesses last year was Products (accounting for 24.7% of the total encrypted information), while topics of Human Resources, Social Responsibility / Sponsorship ... are not mentioned much, invisible significantly reduces the diversity of businesses in the community view.

Figure 4: Top 5 most mentioned topics in media of real estate enterprises

Source: Vietnam Report, Real Estate Media Coding Data from January 2018 to the end of January 2019

Identify key trends of the real estate industry in 2019

According to experts, there are three prominent trends that are forecast to orient real estate growth:

Firstly, the development of environmentally friendly real estate is green - clean - beautiful and environmentally friendly buildings. Currently there are many green standards in circulation such as: Edge (of the World Bank IFC); Green Mark (Singapore), Leed (USA), Lotus ..., but in fact there are very few buildings recognized as "green" in Vietnam. The number of LEED certified projects in Vietnam in 2017 is less than 3%. Compared to Singapore (currently having 37% of green buildings), Vietnam is still far behind. The main reason is that the investment capital of these real estate is very large, requiring professionalism from the stage of designing, constructing, using materials, finishing to operating. In addition, climate change and habitat also significantly affect the "green" standard of the building. However, with increasing requirements and affordability for safer, more comfortable and smarter living spaces of customers, green real estate will surely become the main trend of the industry in the near future.

Secondly, industrial park real estate continues to have potential for growth thanks to the relocation of production into Vietnam in the past few years. Vietnam is strategically located in Asia, bordered by China, and many large seaports are connected to industrial parks by the system of major roads and highways being focused on complete investment. This is considered a very good investment opportunity for investors of industrial parks, especially in the North when the lease demand from large technology corporations such as Samsung, LG ... is increasing very highly.

Thirdly, although it has cooled down compared to the previous year, the resort - tourism real estate still has capacity for development. The latest report of BCG shows that in 2017, Vietnam earned 8.3 billion USD from international visitors, lower than Indonesia at 12.6 billion USD; Singapore is 18.4 billion USD, Thailand is 52.5 billion USD, the reason is not because of fewer tourists coming to Vietnam but because tourists have less opportunity to spend money in Vietnam. It can be seen that the development of high-class resorts, entertainment services, shopping, etc. are not really compatible with Vietnam's tourism potential, so investors can continue to research and developing shophouse and condotel models in the direction of being more modern and customer friendly.

In addition, according to the CIA World Factbook - 2017, Vietnam's urbanization rate is only estimated at 35%, but Vietnam's urbanization rate ranks first in Southeast Asia at 2.6%. /year. At the same time, the increase in the number of foreign workers and engineers working in Vietnam is expected to accelerate the development of residential real estate and condominiums in major cities. In fact, the current supply is still relatively high in all segments: high-end, mid-end and affordable. Therefore, housing real estate, apartments are forecast to remain potential but no sudden change in 2019.

Trends in technology application in real estate brokerage

According to assessment of real estate consulting and brokerage enterprises, one of their biggest shortcomings today is that sales are heavily dependent on employees, the network of employees. and collaborators, making the quite high increase of the cost of sales, while the efficiency is not really as expected. With the development of 4.0 technology and artificial intelligence (AI), businesses expect product marketing and searching for potential customers will be more improved. Accordingly, the application of information technology will help real estate brokage accurately identify more than 70% of customers who want to really buy/ rent house. AI application makes calculations more accurate, the robot will automatically answer questions related to the project, the apartment has been programmed to ensure continuous interaction with customers ...

However, there are also barriers so that stakeholders (including technology providers and real estate brokers) must overcome to be successful: (i) forecast of changes in behavior of buyers and sellers; (ii) reasonable rates; (iii) technology cannot completely replace people; (iv) belief and credibility.

It should also be noted that, in an era of booming information technology, especially in social networks, customers can publicly express their views and appreciation of a real estate product / service by rating. According to a Harvard study, each rating star increases equivalent to a 5-10% increase in business revenue. Therefore, in addition to information transparency, increasing quality in operations, real estate brokers should pay special attention to customer experience and evaluation.

Policies of impact and recommendations of adjustment

According to the Vietnam Report's survey on real estate businesses regarding assessment of the impact of some effective policies related to real estate investment and business, notably, 21, 7% of businesses said that Circular 19/2017/TT-NHNN is having a negative impact on their business activities. However, it is also suggested that credit restriction to real estate will motivate businesses to take initiative in funding instead of credit loan, reducing dependence and risks from borrowings, thereby stimulating the development of other capital investment channels such as bonds, issuing more shares, strengthening investment cooperation with strategic partners ...

To best support real estate for sustainable growth, experts have identified three main groups of solutions:

Firstly, be proactive in the economic development strategy associated with the urban development strategy. The urban development strategy and real estate development should be considered as part of the socio-economic development strategy.

Secondly, be consistent in planning and implementing the plan, to unify the socio-economic development planning, urban development planning and land use planning.

Thirdly, there must be breakthrough policies in the following matters: (i) creating land fund; (ii) capital creation; (iii) adjustment and urban development; (iv) infrastructure development, especially urban infrastructure; (v) Housing development policy for high-end and affordable segments.

The Top 10 reputable Real Estate Companies in 2019 is an independent and objective research result of Vietnam Report published annually since 2016, based on Media Coding method (encoding press data) ) in the media, which has been applied by Vietnam Report and partners since 2012, in combination with in-depth research on key industries with high growth potential such as Banking, Insurance, Securities, Pharmaceuticals, Food. - Beverages, Retail ...

Method of researching and analysing media to assess the reputation of companies based on the Agenda Setting doctrine on the influence and impact of mass media on the community and society was officially published by two professors Maxwell McCombs and Donald L Shaw in 1968, and it was actualized and applied by Vietnam Report and its partners. Accordingly, Vietnam Report used the Branch Coding method (assessing the company's image in the media) to conduct an analysis of the reputation of businesses operating in the real estate industry in Vietnam.

Vietnam Report conducts coding of articles about businesses posted on influential newspapers in Vietnam from January 2018 to January 2019. A total of 987 articles, corresponding to 1,827 coding units, were assessed at the story-level on 24 specific operational aspects of companies from products and business results, market ... to the activities and reputation of company leaders. The information chosen for coding is based on two basic principles: The company name appears immediately on the title of the article, or the news about the company mentioned occupies at least 5 lines in the article. This is called the cognitive threshold as the information is judged to be of analytical value. The information is assessed at the levels: 0: Neutral; 1: Positive; 2: Pretty positive; 3: Unclear; 4: Pretty negative; 5: Negative. However, statistically, the research team gave 3 levels for final evaluation, including: Neutral (including 0 and 3), positive (1 and 2), and negative (4 and 5).

The judgements in the announcement are general and as reference for businesses and partners; are not personally judgement and do not serve the purpose or needs of any specific investor. Therefore, stakeholders should carefully consider the appropriateness of the above information before using it to make investment decisions and take full responsibility for the use of such information.

Vietnam Report

Related news

English

English